[ad_1]

Futures have pulled back overnight ahead of what Nomura’s Charlie McElligott warns is an abnormally large weekly expiry (esp as we rallied into these upside strikes with some violence in just a few days), with 30% of the overall $Gamma in SPX / SPY consolidated options set to roll-off.

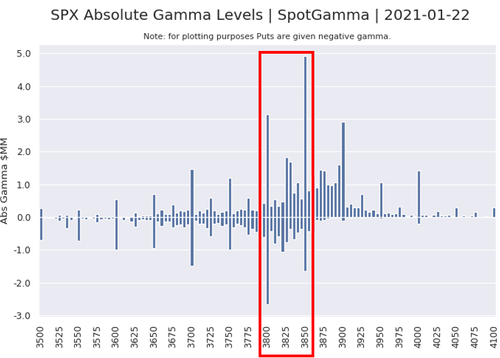

Specifically, SpotGamma points out that there was large “straddle” type volume at 3850 yesterday wherein ~40k each of puts and calls traded at that strike. That seems to have essentially filled in that 3850 level overhead which places the market in a “trough” between the large 3800 large gamma level and the 3850 Call Wall. To this trough idea we note the largest Combo strike is 3832, suggesting this is a sticky area today.

The gamma flip levels continue to slide up, with 3800 marking the transition from positive to negative gamma. There remains little in the way of large net put positions until the 3700 level. The large risk we see here is some type of event that elicits put buying and draws rapid dealer delta hedging (ie shorting futures).

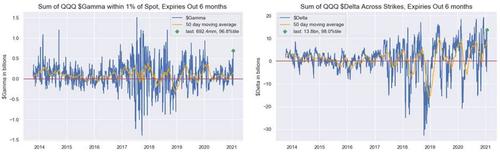

As a result of all this excess, Nomura’s analysis of Nasdaq / QQQ options shows that we have pivoted back towards extreme $Gamma at 96.8%ile and $Delta at 98.0%ile (both since ’13), as traders use options to play for the Secular Growth / Tech recovery after its recent “rotation purge,” on expectations of an “everything up” trade boosted by Rates pausing further selloff / bear-steepening.

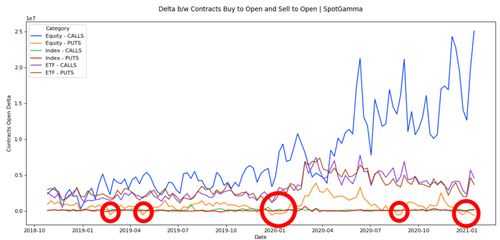

What is even more ominous, as SpotGamma points out is that investors have turned to put options as a way to generate income. Strategically this can be a great strategy, but what does it mean when the MAJORITY of put options are SOLD instead of BOUGHT? In other words: the majority of traders are now using put options as income as opposed to insurance.

The circled areas in the chart above highlight the other times this has happened in the last ~2 years. Specifically this chart measures the amount of an option type that was bought to open against the number that were sold to open. Therefore because the gold line is below zero we know that traders are selling puts to open MORE than buying them to open.

This implies that traders have little fear about a decline in markets, as selling a put option exposes a trader to large losses if the market declines. We think this is an indication of overconfidence, and exuberance in markets.

Checking these periods against a chart of SPY, we can see that the forward returns can be quite ominous.

Specifically, Nomura warns that after settlement, spot Equities could certainly “move” into new ranges post the “Gamma unclenching” in the absence of Dealer hedging flows as well as the absence of the corporate buyback stabilizer during EPS.

[ad_2]

Source link