[ad_1]

As we noted earlier, The Fed’s actions this morning mean “free markets are dead.“

Guggenheim’s Scott Minerd summed up exactly what The Fed has done with its actions today:

“The Fed has made it clear that it will not tolerate prudent and responsible investing.”

The Fed just went full Leeroy Jenkins…

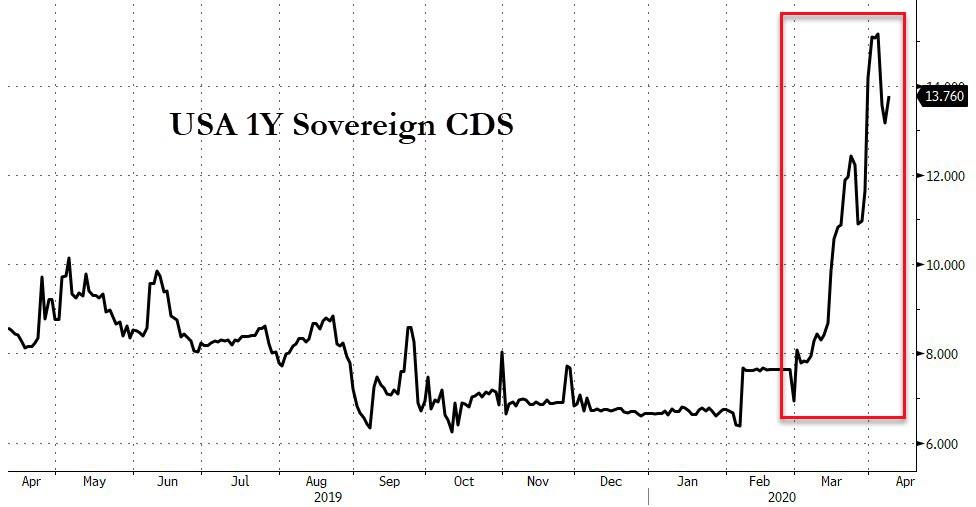

And gold is starting to signal fears over fiat…

Something is brewing…

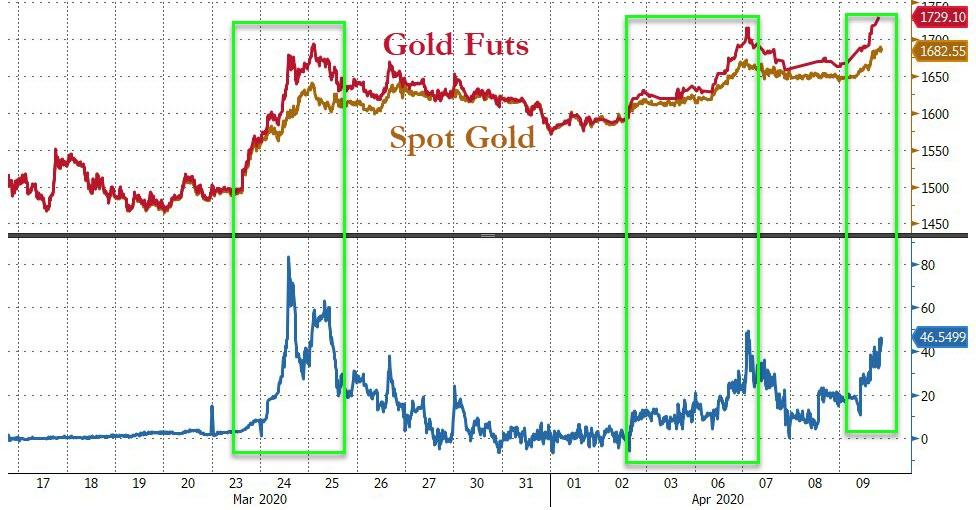

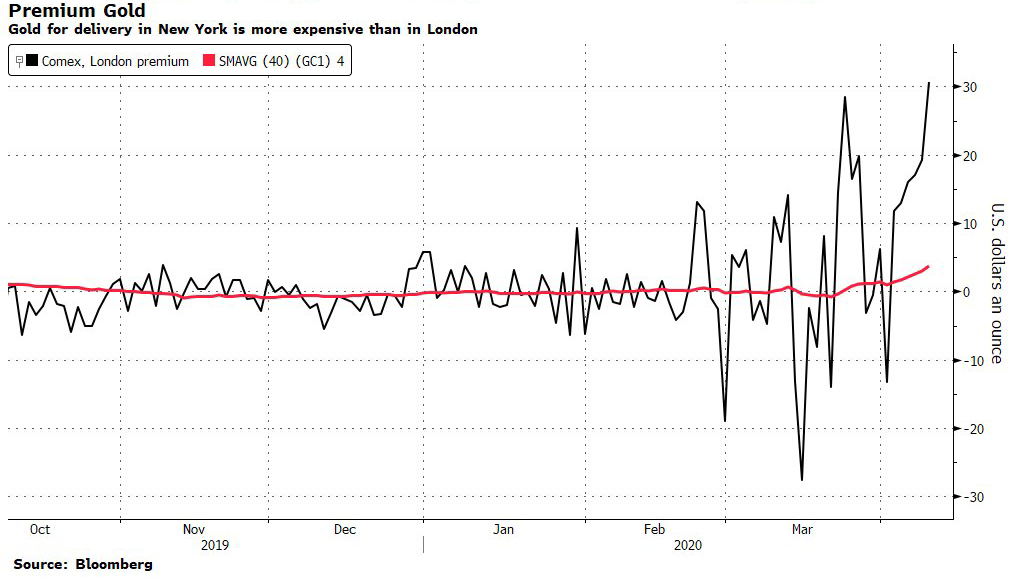

And the spot-futures markets are decoupling as physical (geographic) shortages rear their ugly heads again…

Source: Bloomberg

As Bloomberg notes, the internal mechanics of the gold market are again showing strains under this rally. Gold futures are trading more than $50 above the spot price in London.

Until recently, that was unheard of in a metal that’s so utterly fungible, so easy to transport and where trade channels are so deeply established. But with planes grounded and refining capacity severely restricted, don’t expect the arbitrage to break down immediately.

Bloomberg’s Garfield Reynolds was quick to note, the global business environment is being transformed – we are all socialists now.

This is about more than just the failure of earnings estimates to keep up with the virus impact – investors need to disregard projections that an end to the crisis will restore the pre-outbreak status quo.

Decades of pushing government out of business are being reversed in mere weeks, with policy makers telling companies where, how and if they should operate – whether they can pay dividends, buy back stock or fire employees.

In other words, governments are almost fully taking over free markets, with the profit principle dethroned as the key business driver.

This changes the rules of the game for investors.

Indeed, as Bob Rodriguez details ominously,

With the events of the past three weeks, the perversion and conversion to a dystopian capital market and economic system is virtually complete.

As for me, with the Fed’s announcement of unlimited QE and its “will buy or support almost anything,” along with the pending passage of a $2-2.5 trillion stimulus package, this is the end of the capital markets as we have known them.

We have now entered unlimited QE and MMT where there is no escape.

It is the Roach Motel all over again.

In Chairman Bernanke‘s 2010 Washington Post op-ed, he argued that QE would lead to a virtuous economic cycle; therefore, the Fed would eventually be able to exit from its QE operations. I argued that once initiated, a reversal would be impossible. It would be like the Roach Motel, “You can check in, but you cannot check out.”

With the initiation of the Fed’s complete takeover and control of the US financial economy, there is now absolutely no accurate pricing discovery in the capital markets and we have entered a period of total manipulation. In light of this, the only markets I have an interest in are those where the heavy hand of government is not involved or only minimally involved. This leads me to rare commodities and collectibles. The public equity and debt markets are now nothing more than greater fool markets that are led by the greatest fools of all, the Fed and the Congress. US capital markets, RIP!

This is no small matter!

When everything is essentially socialized as to risk, a return vs risk evaluation is essentially meaningless since the risk side of the equation has been truncated.

Over a period of time which I cannot estimate yet, I will continue my preparation for a far different economic and financial environment.

Capital deployment strategies will likely have to change from what has been the norm in the post WW2 environment. We are in a New World Order.

So let’s survey the damage from The Fed’s “there’s no limit to what we can do” words and actions this morning… and that is perhaps why USA’s sovereign credit risk is beginning to show some cracks…

Source: Bloomberg

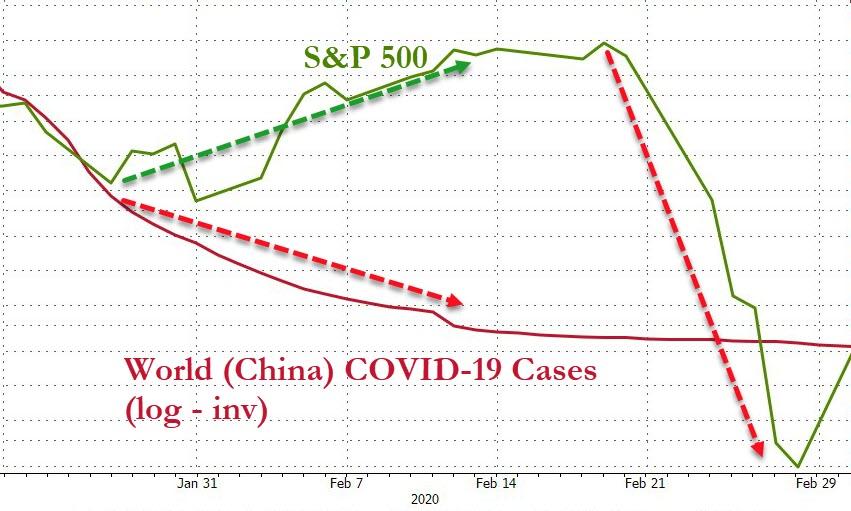

First things first, the market knows best as to when and how the virus peaks…

Source: Bloomberg

Because the market did a great job of understanding the virus when it first broke out…

Source: Bloomberg

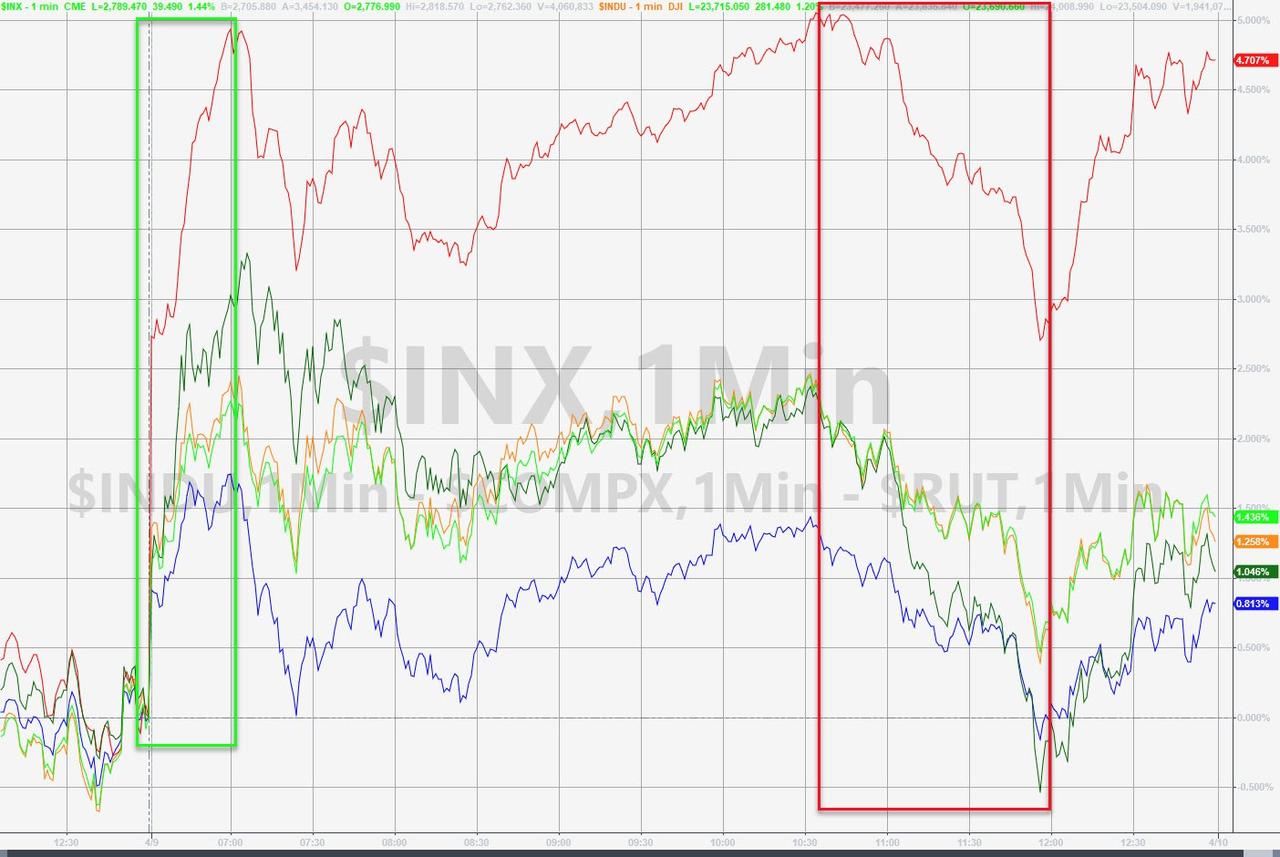

Stocks loved The Fed’s actions but as futures show, the effect of yet another $2.3 trillion in promises wore off fast…

Small Caps were best on the day as Nasdaq lagged…

This (admittedly shortened) week was among the market’s all-time best week’s ever…Small Caps were up a stunning 17%-plus and The Dow gained over 12.63% – the second best week since 1938 (+12.845% 2 weeks ago, +12.59% Oct 1974, +14.15% Jun 1938)

This was the biggest short-squeeze week ever…

The Dow tagged a 50% retracement, then fell…

The Dow is up 30% from its lows…

The other big story of the day was OPEC’s utter failure – after spreading rumors of a possible 20mm production cut… they managed less than half of that for just two months…

…and WTI went from +12% to -8% on the day…

The Dollar traded lower today…

Source: Bloomberg

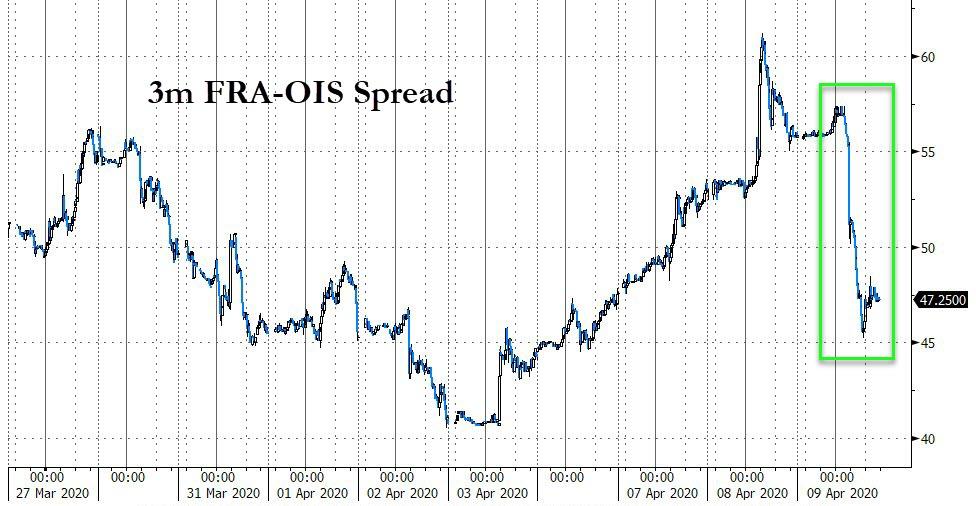

As The Fed’s actions may have alleviated short-term dollar liquidity stress…

Source: Bloomberg

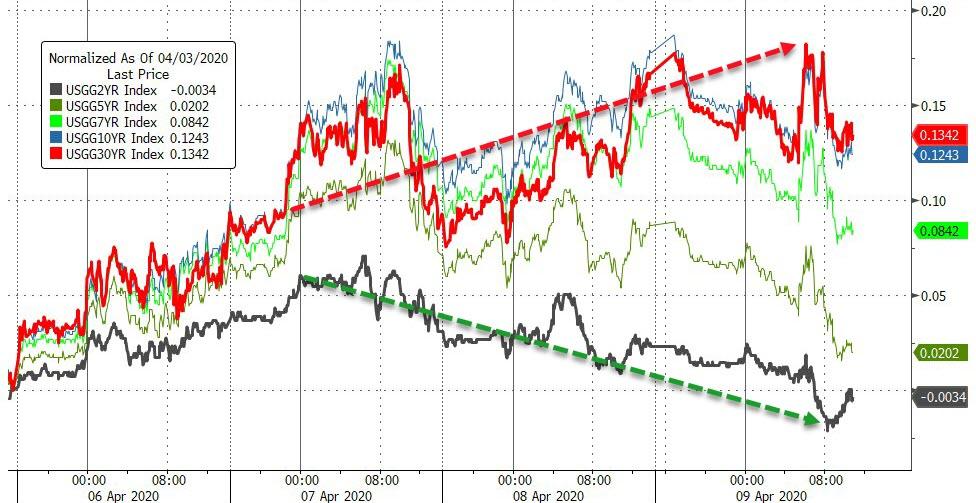

Treasury yields were lower today (even with stocks bid), but the curve continued to steepen with the short-end outperforming…

Source: Bloomberg

10Y remains rangebound…

Source: Bloomberg

The Fed’s “we’ll buy any and all of your crap” policy sent HY credit markets soaring with HYG having its best day ever…

Notably, HY “caught down” to VIX today again…

Source: Bloomberg

Crytpos were flat to modestly lower today, holding the week’s gains…

Source: Bloomberg

While gold and oil stole the headlines, silver was best among the major commodities…

Source: Bloomberg

This week’s ugliness in crude and strength in silver has left the Oi/Silver ratio at a record low… well below the apparent ‘floor’ of 1.5 ounces of silver per barrel that has been in place for 35 years…

Source: Bloomberg

Kyle Bass once said, “Buying Gold Is Just Buying A Put Against The Idiocy Of The Political Cycle. It’s That Simple!”

Source: Bloomberg

It seems that insurance is starting to pay off.

So stocks have two of their best weeks ever… and the US economic data suffers its worst monthly crash ever…

Source: Bloomberg

The reason stocks rallied…

Fun-durr-mentals? Nope!

Source: Bloomberg

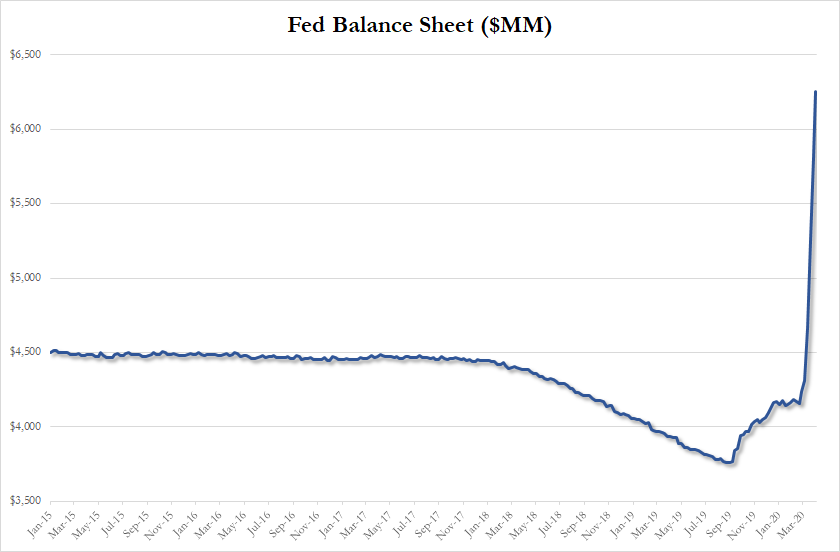

Simple! – The Fed injected $440BN in last week, total is now $6.3 trillion

And stocks are now more expensive than they were at the peak in price…

Finally as Mercutio McG (@JAMcGinley), noted so poignantly, “if the market gets back to ATHs while we are shutdown, it only proves the bears right. That the whole thing was a giant Fed fueled ponzi.”

[ad_2]

Source link